In the vast realm of global finance, understanding the dynamics of currency exchange rates is akin to navigating a complex labyrinth. One term that often surfaces in financial conversations is the CIB exchange rate. What exactly does it entail, and why is it crucial for investors, businesses, and even casual observers of the financial landscape? In this comprehensive guide, we will unravel the intricacies of the CIB exchange rate, exploring its significance, factors influencing it, and its implications on the global economic canvas.

Decoding CIB Exchange Rate: What is it and Why Does it Matter? (H1)

The CIB exchange rate, short for Central Bank of the issuer, is a pivotal indicator reflecting the value of a country's currency concerning another currency. Unlike conventional exchange rates, CIB rates are often used in the context of sovereign bonds, international trade, and central bank policies. This section will delve into the fundamental principles behind CIB exchange rates and their paramount importance in the financial landscape.

Factors Shaping CIB Exchange Rates (H2)

1. Economic Indicators and Monetary Policies (H3)

At the heart of CIB exchange rate fluctuations lie a multitude of economic indicators and monetary policies. Central banks play a pivotal role in influencing these rates through interest rate adjustments and other monetary instruments. We will explore how economic indicators such as inflation, GDP growth, and employment rates impact CIB exchange rates, providing readers with a nuanced understanding of the intricate interplay between macroeconomic factors and currency values.

2. Political Landscape and Geopolitical Events (H3)

In the world of currency dynamics, politics matter. This section will shed light on how political stability, elections, and geopolitical events can send ripples through CIB exchange rates. An in-depth analysis will showcase real-world examples where political shifts have triggered significant fluctuations in currency values, emphasizing the need for investors and policymakers to stay attuned to the political pulse.

3. Trade Balances and Currency Reserves (H3)

A nation's trade balance and currency reserves are vital determinants of its currency's strength. This subsection will dissect the relationship between trade surpluses or deficits and CIB exchange rates, offering insights into how a country's economic health, as reflected in its trade activities, can impact the value of its currency in the international arena.

Navigating the Perplexities of CIB Exchange Rate Movements (H2)

1. Perplexity Unveiled: Volatility in Currency Markets (H3)

Currency markets are inherently volatile, and CIB exchange rates are no exception. This segment will demystify the concept of perplexity in the context of currency movements, elucidating how sudden shifts and fluctuations in CIB rates can pose challenges and opportunities for investors. Real-world examples will be used to illustrate the dynamic nature of currency markets.

2. Burstiness in CIB Exchange Rates: Understanding Sudden Surges (H3)

Burstiness, or sudden surges in CIB exchange rates, can catch even seasoned investors off guard. This part of the guide will explore the causes behind burstiness, ranging from unexpected economic data releases to geopolitical shocks. By comprehending the burstiness factor, readers will be better equipped to navigate the unpredictable terrain of currency markets.

Implications of CIB Exchange Rates on Global Finance (H2)

1. International Trade and Investment (H3)

As businesses expand globally, understanding CIB exchange rates becomes paramount. This section will elucidate how CIB rates impact international trade and investments, influencing the competitiveness of nations in the global market. Real-world case studies will highlight the tangible effects of CIB exchange rate movements on businesses and economies.

2. Central Bank Policies and Interest Rates (H3)

Central banks wield considerable influence over CIB exchange rates through their monetary policies. This subsection will provide insights into how interest rate decisions and other policy measures influence currency values, emphasizing the interconnectedness between central bank actions and the global financial landscape.

Conclusion (H1)

In conclusion, the CIB exchange rate is not just a numerical value on financial charts; it is a reflection of the intricate dance between economic, political, and trade dynamics on the global stage. Investors, policymakers, and enthusiasts alike must grasp the nuances of CIB exchange rates to make informed decisions in an increasingly interconnected world.

Frequently Asked Questions (FAQs)

Q1: How often do CIB exchange rates change?

CIB exchange rates can change daily, sometimes even multiple times a day, depending on various factors such as economic data releases, geopolitical events, and market sentiment.

Q2: Can CIB exchange rates be predicted with certainty?

Predicting CIB exchange rates with absolute certainty is challenging due to the multifaceted nature of the factors influencing them. While trends and patterns can be analyzed, unforeseen events can lead to unexpected fluctuations.

Q3: How do CIB exchange rates impact individual investors?

Individual investors can be affected by CIB exchange rate movements, especially if they have international investments or engage in forex trading. Understanding these rates is crucial for managing risks and making informed investment decisions.

Q4: What role do central banks play in influencing CIB exchange rates?

Central banks use various monetary tools, such as interest rate adjustments, to influence CIB exchange rates. Their policies and interventions can have a significant impact on the value of a country's currency.

Q5: Are CIB exchange rates the same as regular exchange rates?

While both CIB exchange rates and regular exchange rates reflect currency values, CIB rates are often associated with sovereign bonds and central bank policies, making them distinct in their focus and implications.

1. CIB Bank Foreign Exchange Rates

Foreign Exchange rates · Buy375.1 · Middle382.75 · Sell390.4 · CIB/EKB1.99%.

Have any doubts? Get a call back

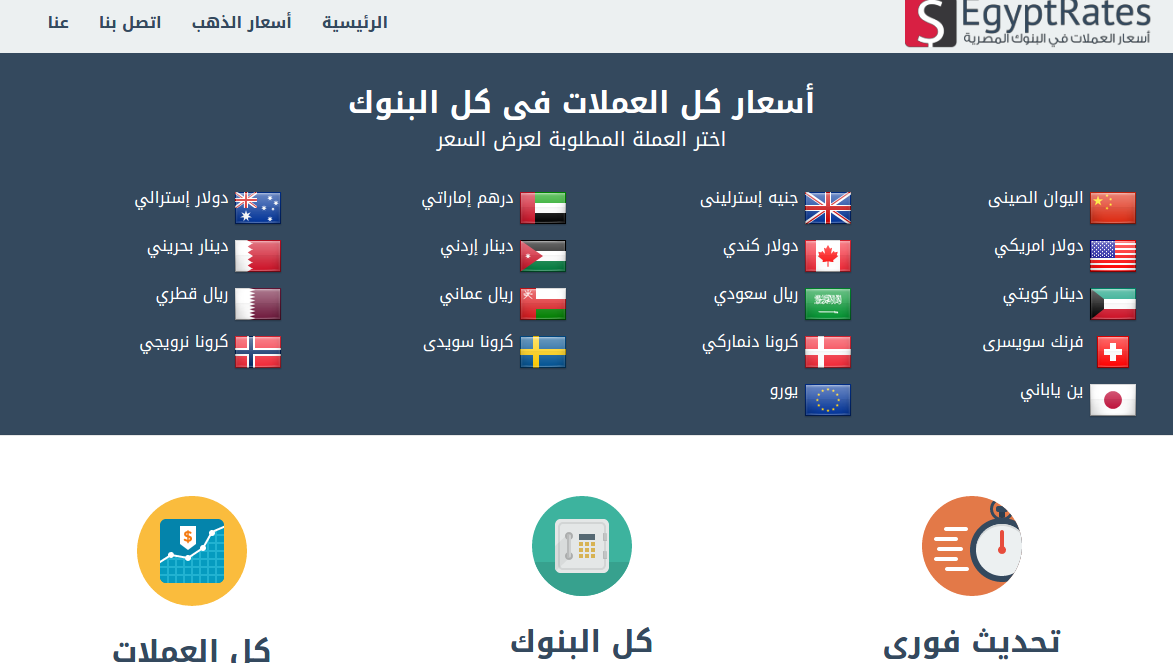

2. CIB Bank Currency Exchange Rates Sunday 31 Dec 2023 - EgyptRates

Currency Exchange Rates ; CIB Bank, Kuwaiti Dinar/KWD, 97.304 ; CIB Bank, Saudi Arabian Riyal/SAR, 8.185 ; CIB Bank, British Pound/GBP, 39.300 ; CIB Bank, Swiss ...

سعر جميع العملات لحظة بلحظة من بنك CIB Bank تحديث دورى للأسعار من جميع البنوك

3. Exchange Rates in Commercial International Bank (CIB) - بنك لايف

Exchange Rates in Commercial International Bank (CIB) Sat 30 Dec 2023 ; Euro, 33.9196 EGP. (0.182). 34.175 EGP. (0.1145) ; Pound Sterling, 39.0993 EGP. (0.1882).

Commercial International Bank (CIB) Currency rates Live, Currency Watch in Commercial International Bank (CIB) against Egyptian pound Follow-up time to currency exchange rates in Commercial International Bank (CIB) Note that currency exchange rates in Commercial International Bank (CIB) are changed daily and around the clock and you can follow the exchange rate at Commercial International Bank (CIB) Live through the price table Currencies in Commercial International Bank (CIB) above. The last update for the currency rate was in Commercial International Bank (CIB) at 54 Year

4. Exchange rates Corporate and Investment Bank - Absa

Absa Exchange Rate ; AED, United Arab Emirates Dirham, /, 0.21079000, 0.00000000 ; AUD, Australian Dollar, /, 0.08426256, 0.08526256 ...

Absa Group Limited - Up to date Corporate and Investment Bank exchange rates

5. Exchange Rates in Commercial International Bank ( CIB ) Today

Exchange Rates in Commercial International Bank ( CIB ) Today ; US Dollar · 30.85 · 30.95 ; Euro · 34.16 · 34.485 ; British Pound · 39.3 · 39.7 ; Saudi Arabian Riyal.

Menu

6. Foreign Currencies - Mayfair CIB Bank

Country, Currency, Bank Buy Cash, Bank Sell Cash. USD, 139.20, 146.50. GBP, 173.90, 183.00. EUR, 148.60, 156.40. ZAR, 7.50, 8.10. INR, 1.6890, 1.8040 ...

Follow us on our Social Media

7. CIB Bank Hungarian Forint vs UK Pound Exchange Rate - Euro Transfer

CIB Bank charges around 5.0% exchange rate for bank money transfers between the Hungarian Forint HUF and the UK Pound GBP, you can beat CIB Bank rates.

CIB Bank charges around 5.0% exchange rate for bank money transfers between the Hungarian Forint HUF and the UK Pound GBP, you can beat CIB Bank rates

8. CIB Bank Hungary – HUF Exchange Rates - Euro Transfer

CIB Bank Hungary – Forint (HUF) vs European Currency Exchange Rates ; HUF/GBP (BROKER RATES), FROM £100, 1 DAY ; HUF Ft - to CHF, NO MINIMUM, 5/7 DAYS ; HUF Ft - ...

You can beat CIB Bank exchange rates when making a Forint (HUF) money transfer to or from an overseas bank and your account in Hungary

9. CIB Bank Money Transfer | UK Pound & Hungarian Forint Rates

A better exchange rate when transferring money overseas from your CIB Bank account in Hungarian forint, euros, the UK pound & other currencies.

CIB BANK HUNGARY UK POUND & EURO to HUF EXCHANGE RATES Table *GUIDE RATES are updated daily (Monday to Friday) at 09:00 GMT. ...

10. Commercial International Bank - Egypt (CIB) (COMI) - Mubasher Info

11.07 Egyptian Pound Based on: Third Quarter 2023. P/E Ratio 9.88 Last update: 2019-06-02. Trading Currency Egyptian Pound. Company Statistics. Current Total ...

The homepage of Commercial International Bank - Egypt (CIB) (COMI) that displays the stock chart and the main information about the stock - Mubasher Info

11. Forex - BNP Paribas CIB

Forex. Corporate Banking. Our smart FX-solution enables you to manage cross-border payments in different currencies. We have created an optimal FX tool well- ...

Our two FX solutions enable you to handle your cross-border and multi-currency payments automatically and rapidly.

12. CIB Bank SWIFT codes in Hungary - Wise

Get a better deal for sending money abroad. Wise is the cheaper, faster and easier way to get the real exchange rate. Join over 16 million people who save when ...

Easily find the correct SWIFT (BIC) code for CIB Bank in Hungary and all information necessary for a successful international bank transfer.

13. Providing Capital Markets solutions | Crédit Agricole CIB

500.78 KB. Bond Auctions and Buybacks Disclosure for…Bond Auctions and Buybacks Disclosure for Rates Clients. View. English. PDF. 517.67 KB. Global Markets ...

Crédit Agricole CIB's sales and trading activities are supported by dedicated research departments.

14. CIB Terms of Business | Legal - Capital International Group

... currency of the Primary CCA at our prevailing exchange rate on the day the fee is applied. d) Any transaction costs or charges incurred in connection with ...

Visit to view our CIB Terms of Business and access other legal information.

15. Other information: Corporate & Investment Banking - BBVA

At current exchange rate: -60.4%. Financial statements and relevant business ... CIB generated a net attributable profit of €93m euros in the first quarter ...

The Quarterly report annex includes information on Corporate & Investment Banking and the key highlights for business activity